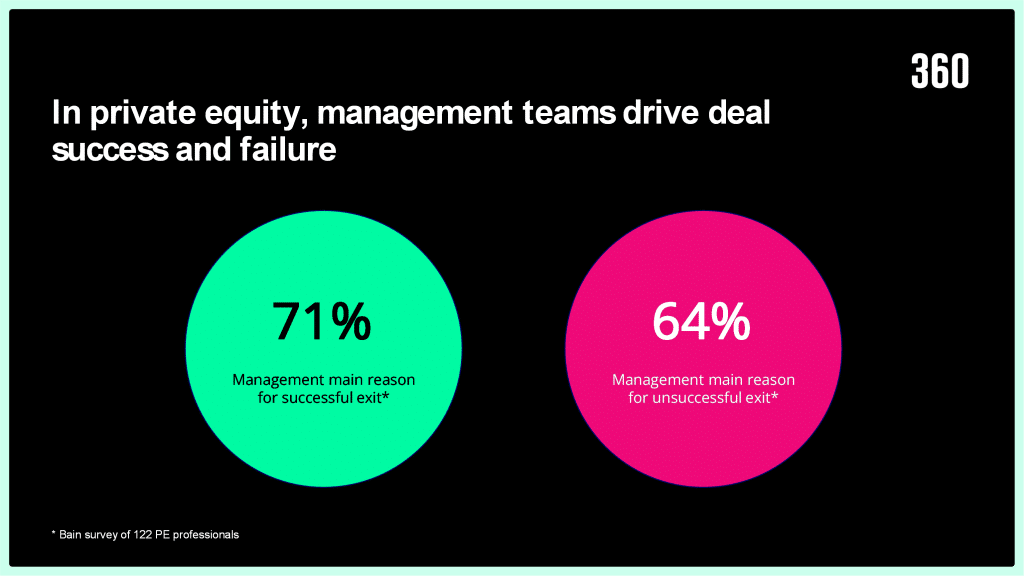

The quality of a portfolio company’s management team is the main reason for private equity deal success and failure.

So, in the fact-based world of private equity, why are so many talent decisions made based on ‘gut feel’?

360Leaders takes a look at the traditional approach the talent management in private equity, why it goes wrong and outlines our innovative approach to making better talent decisions and generating superior investment returns.

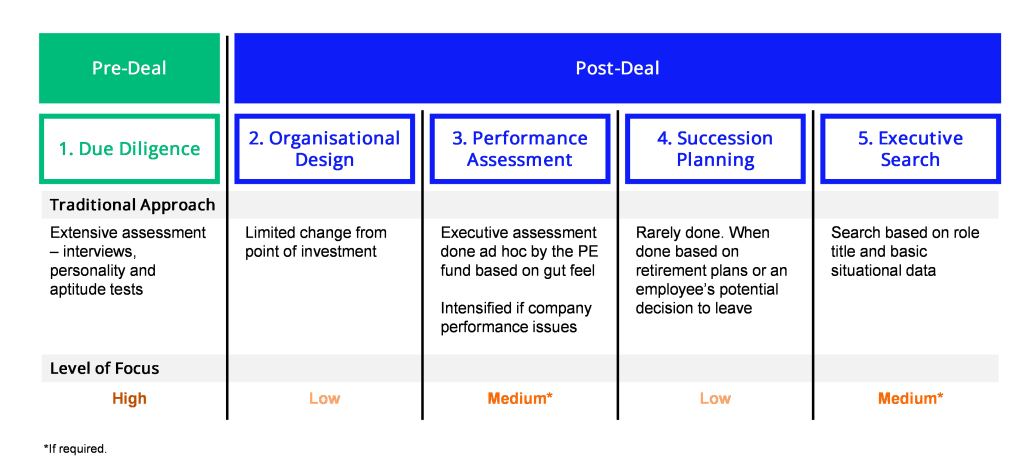

The traditional approach to talent management in PE

Talent management in private equity typically focuses a lot of time and energy on Due Diligence. Post-deal, PE fund involvement is often limited to executive performance assessment if there are company performance issues. If changes to the management team need to be made, the fund is often involved in the search process for the new executive, especially if it is for a CEO.

The below graphic summarises the components of executive talent management across the deal cycle and the traditional approach:

Problems with the traditional approach

The traditional approach creates problems in each component of executive talent management:

- Due Diligence is not linked to the VCP: While a lot of time and money is spent on Management DD, it is often disconnected from the value creation plan (VCP). Understanding the experience, capabilities and personalities of individual managers is important. Yet you do not want a ‘good’ management team, you want the ‘right’ management team to deliver the VCP.

- Organisational Design is not reviewed in implementation: Once the deal is done there is typically a flurry of activity in the first 100 days. Addressing specific points raised in DD and setting the company up operationally to deliver the VCP. One area that almost always gets overlooked is Organisational Design. Deals typically include a change in strategy, so the old organisational design is unlikely to be optimal. In addition, role descriptions and objectives are often not refined to reflect the VCP.

- Performance Assessment is based on gut feel: When company performance is not as expected, the PE fund typically gets involved in executive performance assessment. Yet without clear role descriptions and objectives, it can be difficult to do this is a fact-based way. As a result, talent decisions often taken too long and are based on exchanges fuelled by gut feel, and assessment of board contributions, rather than facts of day-to-day operational delivery and performance.

- Succession Planning lacks linkage to strategic triggers: It is not surprising that given the dramatic changes that take place during a PE holding period, many executives do not make it to exit. However all too often these changes have not been anticipated, and succession planning is not as developed as it should be. This results in lost time and delivery delays during the search and onboarding of a new hire.

- Executive Search does not consider the strategic and organisational context: Most Executive Search firms do not fully understand or explore the strategic and organisational context they are hiring a role into. They focus on the job title, and basic factors such as company size and number of employees in the team. Factors such as future strategic objectives, performance challenges with current team and interactions with other executives are not taken into account. As a result, hiring can take longer than necessary as the role is not clearly defined. The selected candidate, while smart and accomplished, may also not be optimal for the role.

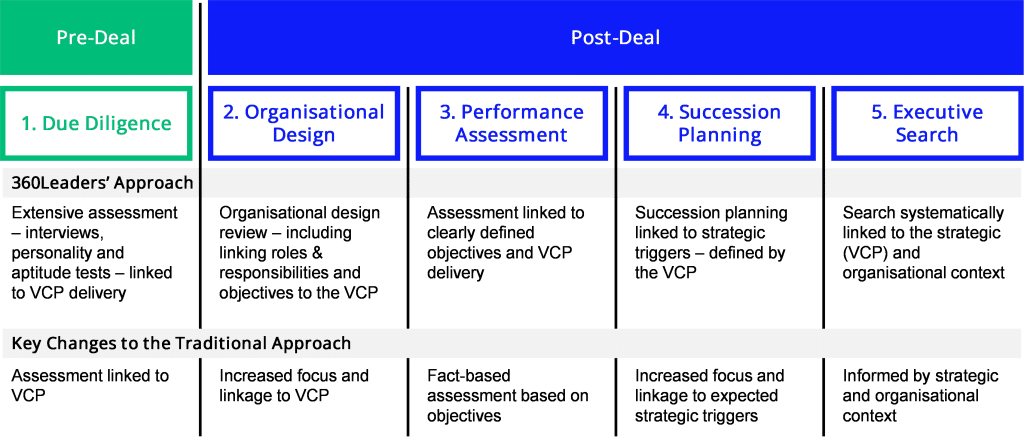

A fact-based approach to talent management

360Leaders has pioneered a new systematic and fact-based approach to executive talent management in private equity. It resolves the problems created by the traditional approach.

Our team of ex-commercial and strategic operators has a different set of capabilities to existing executive talent management service providers. These differentiated capabilities underpin our differentiated approach.

Each element of our approach systematically links decisions to the VCP, in a fact-based and integrated manner. This leads to better talent decisions, superior VCP delivery and enhanced investment returns.

Want to find out more about our approach to executive talent management in private equity? Talk to one of our experts